Stock average price formula

If the stock price recovers to the 1st purchase price of 5000 the total value of the investment will. The average price of a bond is calculated by adding its face value to the price paid for it and dividing the sum by two.

How To Calculate Weighted Average Price Per Share Fox Business

We can calculate the stock price by simply dividing the market cap by the number of shares outstanding.

. So far for just buying and then later selling I have been calculating the avaege buy price using this formula. Time to achieve Excellence in ExcelIn this video you will learn how to calculate the average price in Excel. How Does Stock Average Calculator Works.

The average price reduces the stock into a single value and the price is compared to previous prices to determine if the value is higher or lower than what would be expected. The VWAP formula only uses intraday information to calculate the average price. Consider the following information.

In this example multiply 100 by 10 to get 1000 multiply 200 by 7 to get. Stockamount price stockamount price stockamount. Lets now apply the formula for stock valuation in an example.

The average price is sometimes used in. List the various prices at which you bought the stock along with the number of shares you acquired in each. You can simply take out the average cost and get to know the value of each stock.

Calculate Your Total Cost. The volume-weighted average price formula is as below. This changes the cost basis from 5000 to 3000 which is a difference 2000 or 4000.

To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858. There is a simple formula that can help you know the average cost. For example the mathematical average of 100 and 200 is 150 but if you bought 10 shares of stock at 100 and only one share at 200 the lower-priced shares carry.

The average selling price ASP is a term that refers to the average price a good or service is sold for. Cost Basis Average cost per. Lets say you buy 100.

Take an example you bought 10 stocks of Tata Motors at a price of. Here are the steps to calculate a weighted average trade price. Reflects the cost of equity.

This is part of a video series and dives deep i. To find the weighted average you multiply the number of shares by the price you paid for that transaction then add the number of shares you paid by the per-share price in your. ASP is simply calculated by dividing the total revenue earned by.

Multiply the number of shares in each transaction by its purchase price. If you buy a stock multiple times and want to calculate the average price that you paid for the stock the average down calculator will do just that. Stocks Under 1 2.

Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost. Have a look at the formula mentioned. Volume-Weighted Average Price.

In other words we can stay that the Stock Price is calculated as. For this you will start adding more stocks to reduce the average price of a stock.

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

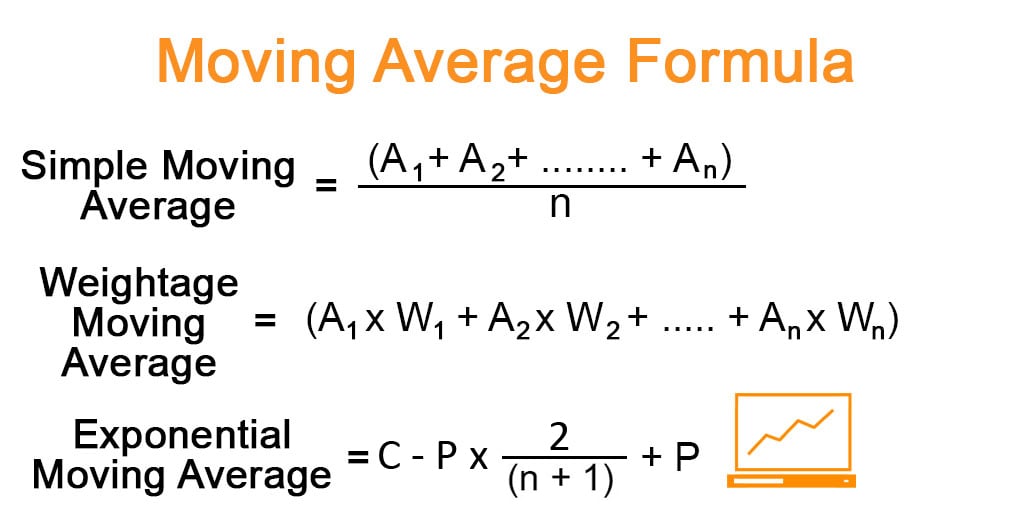

Moving Average Formula Calculator Examples With Excel Template

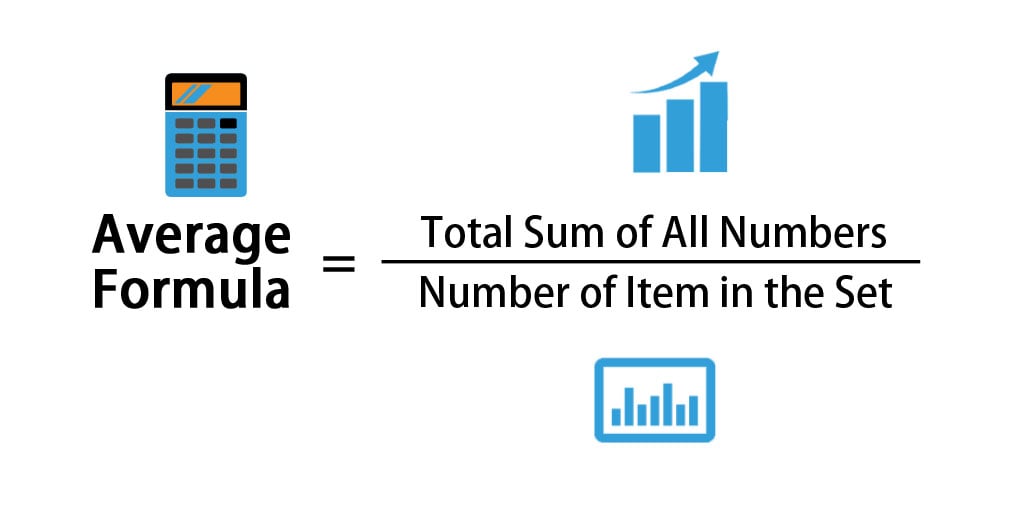

Average Formula How To Calculate Average Calculator Excel Template

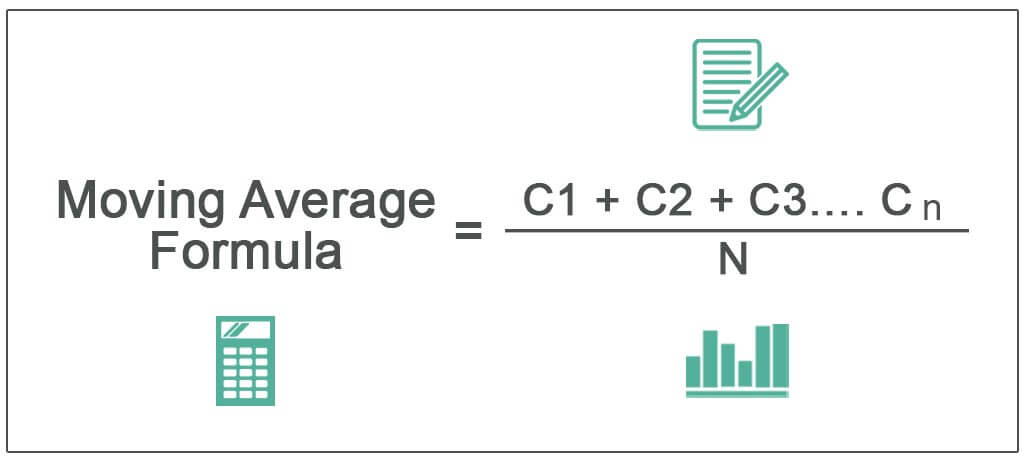

Moving Average Definition Formula How To Calculate

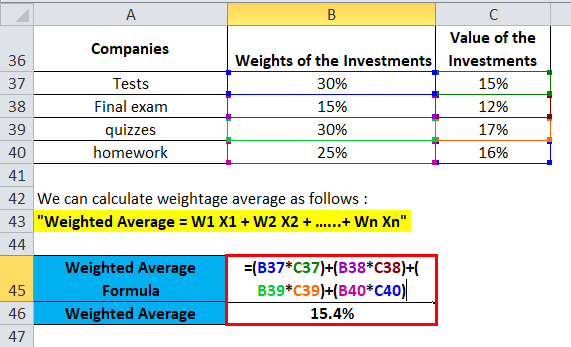

Weighted Average Formula Calculator Excel Template

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

Weighted Average Cost Accounting Inventory Valuation Method

Wacc Formula Definition And Uses Guide To Cost Of Capital

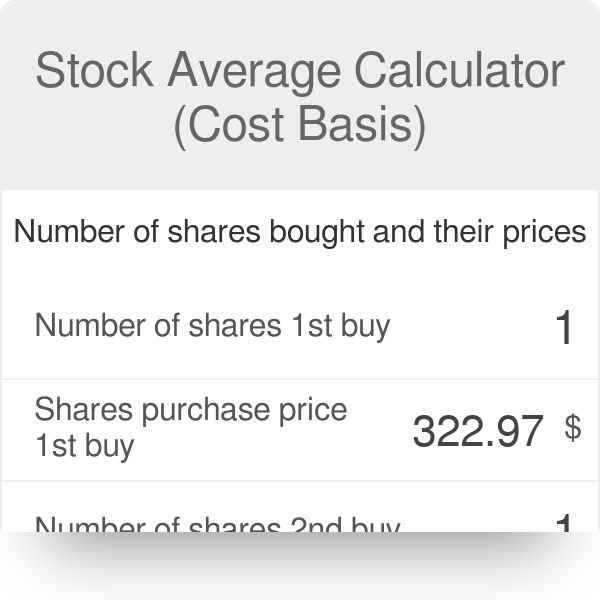

Stock Average Calculator Cost Basis

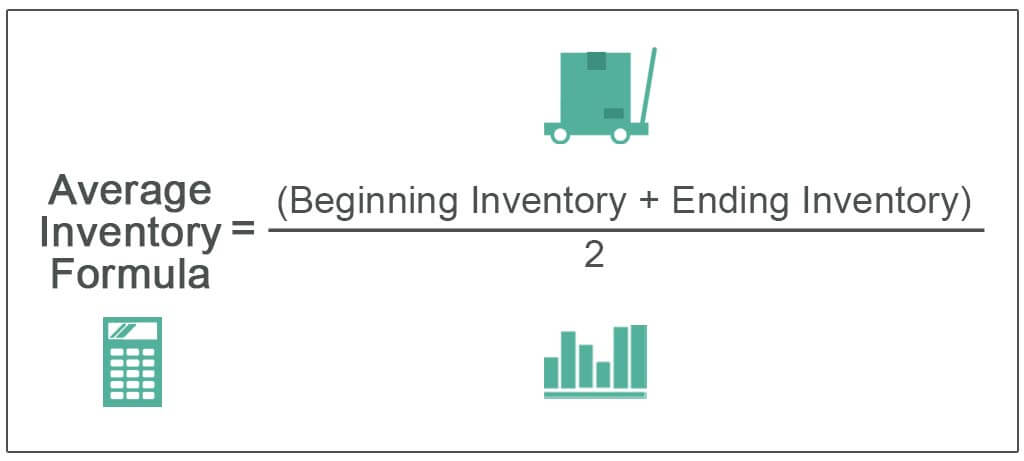

Average Inventory Formula How To Calculate With Examples

Stock Average Calculator Cost Basis

Cost Of Preferred Stock Rp Formula And Calculator Excel Template

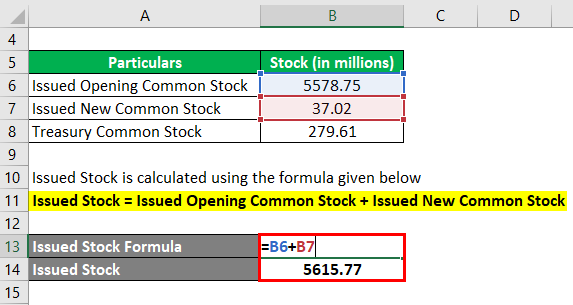

Shares Outstanding Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

Average Price Definition

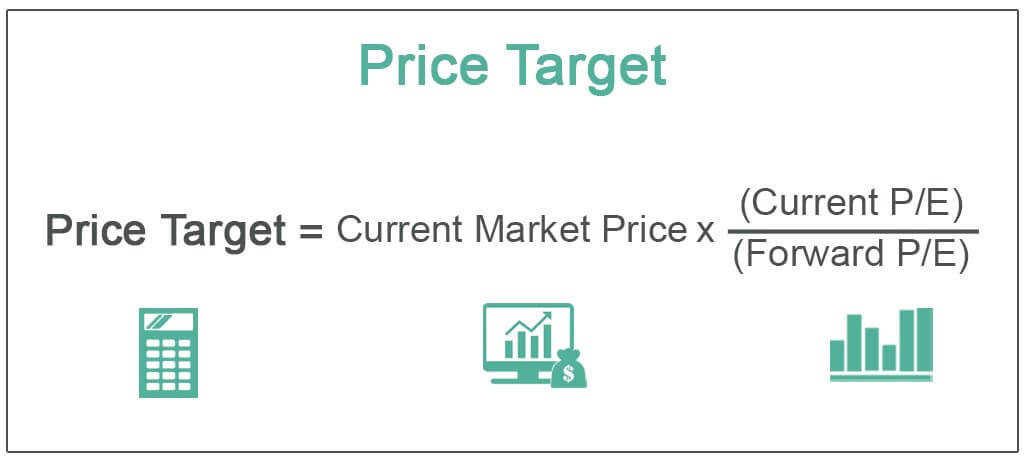

Price Target Definition Formula Calculate Stocks Price Target

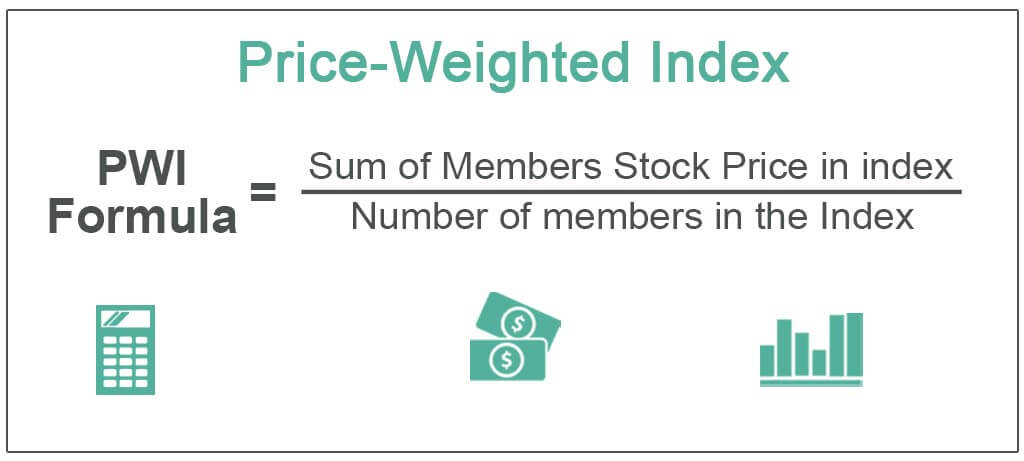

Price Weighted Index Formula Examples How To Calculate